KAW PING Co., CPAs (BWKP)

KAW PING Co., CPAs (BWKP)Services

Transfer Pricing

What does transfer pricing imply?

“Transfer pricing” refers to the price or profit set for controlled transactions between the profit-seeking enterprise and related party. Our country promulgated “Regulations Governing Assessment of Profit-Seeking Enterprise Income Tax on Non-Arm's-Length Transfer pricing” on December 28, 2004. The regulations stated that, when declaring income tax starting from the 2005, companies that comply with the assessment regulations shall submit transfer pricing report to the competent authority for assessment.

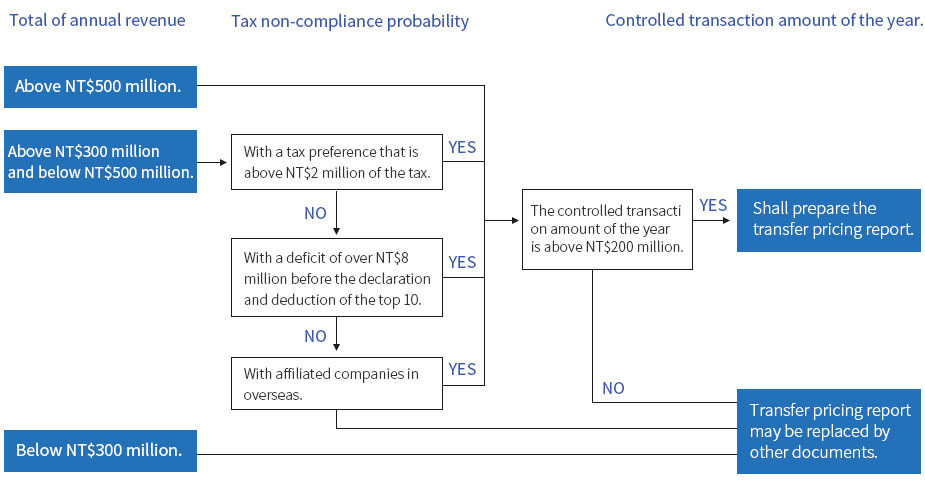

Who needs to make transfer pricing report?

Almost every listed company is required to make transfer pricing report. Large-sized TWSE (or GTSM) listed and public companies, players of technology industry, group enterprises, transnational enterprises and those with affiliated companies in overseas whose controlled transaction amount of the year is above NT$200 million all comply with this standard set by the Ministry of Financial Affairs. Examples like Foxconn, TSMC, Asus, Acer and Formosa Plastics, which are globally deployed enterprises that have established affiliated companies for division of labor and manufacturing, shall all make transfer pricing report.

Why do we need to make transfer pricing report?

1. To prevent companies from avoiding income tax burden through transfer pricing:

As the levy of income tax will reduce companies’ profit after tax, profit-seeking enterprises that are challenged by different income tax systems around the world sometimes adopt controlled relationship based pricing strategy for inter-company transactions (i.e. transfer pricing) to optimize their global profit after tax. By doing so, the profit will be counted on the side with lower or no tax burden in order to reduce the group’s total tax burden.

2.To facilitate tax burden management among companies in order to reduce risks derived from tax burden around the world:

Transfer pricing analysis is counted as a process of income tax declaration starting from 2005. This is when companies started to notice risks derived from risk burdens and transfer pricing report enables companies to review their global profit distribution, ensuring that it is reasonable and that they will not be charged with additional tax by national taxation bureaus of the region.

Compliance with the standard procedures of making transfer pricing report.

Transfer pricing in mainland China.

According to Letter No. 363 issued by national taxation bureau of mainland China in July of 2009, Companies that engage in one single activity in mainland China, such production, retailing services or contractual research and development, shall prepare transfer pricing report for the year of deficit regardless the transaction amount. The said report shall be submitted to the national taxation bureau before June 20. The original transfer pricing safe harbor (RMB200 million) for Taiwanese companies in mainland China was removed instantly after the issuance of Letter No. 363. That is, any company with a deficit shall submit the report within the prescribed deadline.

Service Content

Pre-assessment of transfer pricing

Production and Operation Analysis

Related Transaction Analysis

Comparability Analysis

Making transfer pricing report